Startup Funding

ICYMI the Startup markets are getting hotter in the Data Science space. Every time I turn around, some small company got millions of dollars in startup funding. It used to be a company with an algorithm or data science library but now it’s Data Science platforms. These platforms are suddenly all the rage and many new entrants are racing to gain market and mind share.

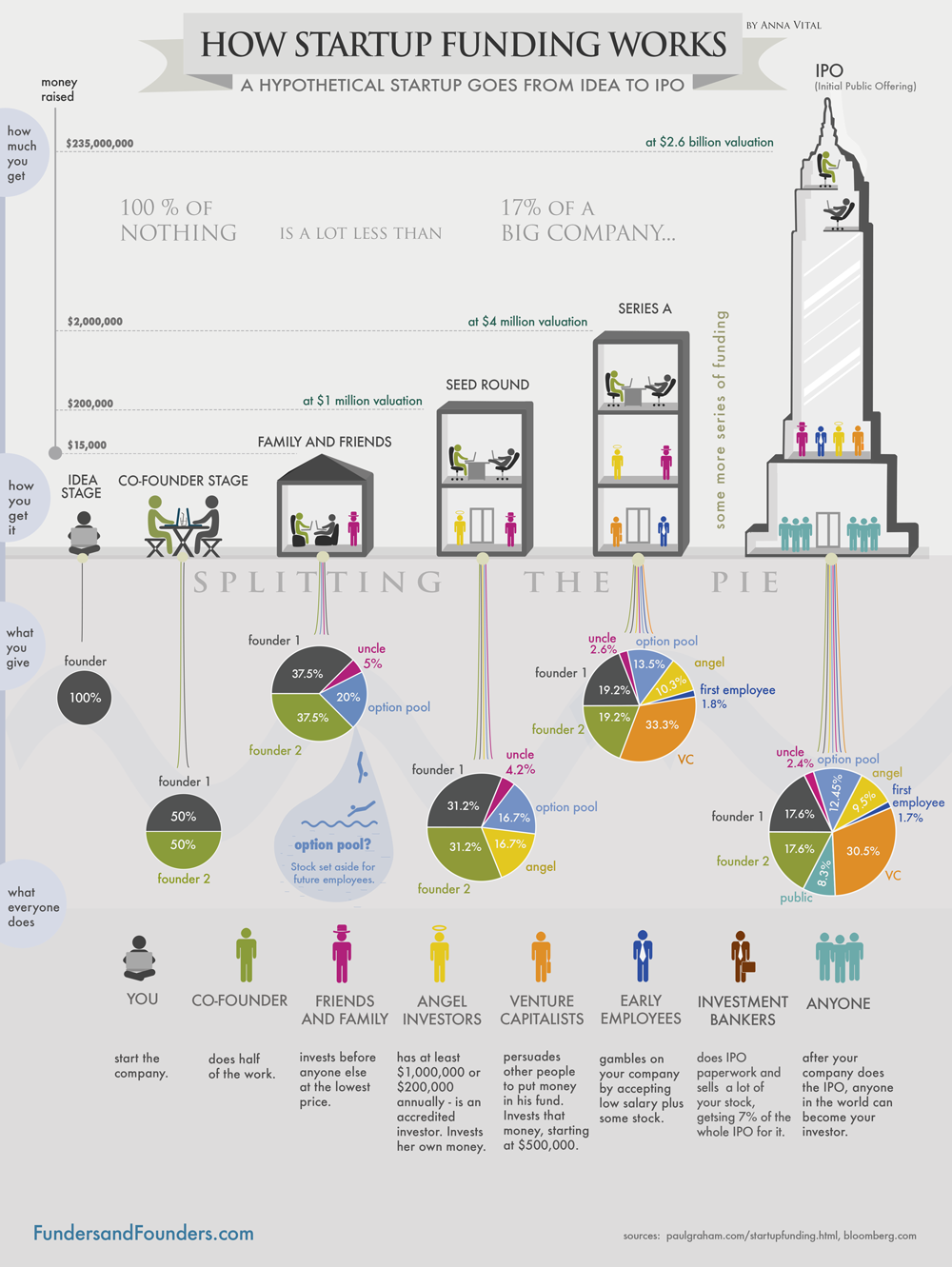

The above image from FundersandFounders.com really captures a successful startup from inception to IPO. Most interesting for me is how the ownership “pie” is cut over time. If you’re the Founder, you first start out with a 50/50 share with your Co-Founder. Then you get some Seed money, say from an Angel Investor like Howard, which takes a small % of ownership.

Startup Growth

As the Startup grows and matures it should attract more VC money and the ownership pie changes. With every VC investor, you sell parts of your company. This is incredibly important if you want to maintain control of your company and should be carefully analyzed.

My personal opinion is that you can do all this without VC money but it will be harder and take a longer time. It could take decades and in this industry time is not your friend. The market is so hot that your competitors will fill your weaknesses in the market within a quarter or shorter. So in essence you really need startup funding from VC’s to be agile and build/keep your market share. Just keep an eye on those term sheets and make sure that the “pie” is big enough for everyone.

Originally published at Neural Market Trends.